The great lesson since the onset of COVID is that anything is possible. Don’t get me wrong, I’m not predicting there will be a 50% decline in the stock market. I’m not predicting anything, because I can’t. Nobody can consistently!

The great lesson since the onset of COVID is that anything is possible. Don’t get me wrong, I’m not predicting there will be a 50% decline in the stock market. I’m not predicting anything, because I can’t. Nobody can consistently!

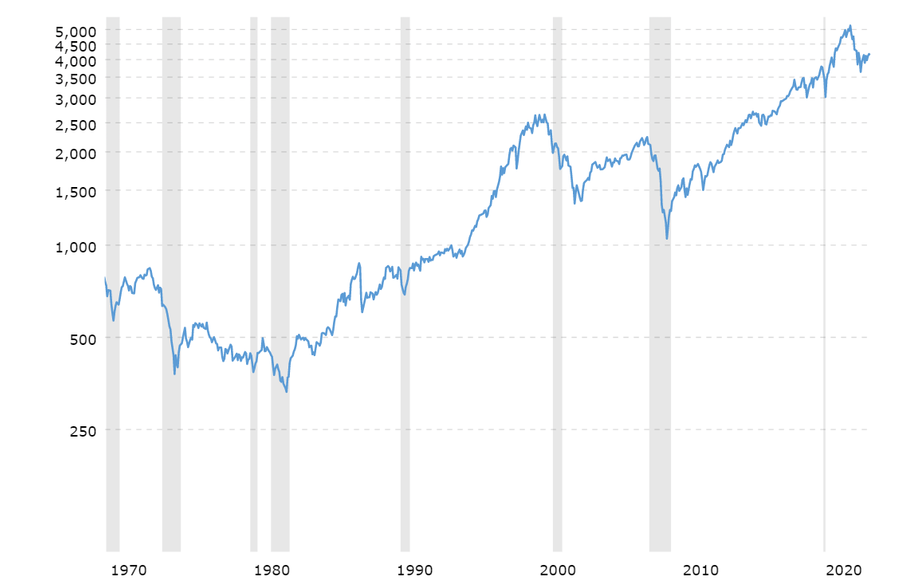

If you are reading this and over age 15, I remind you that a 50% market decline has happened at least once in your lifetime … and almost a 50% decline two other times in our lives since the 1970s for those of us age 50+ according to The Complete History of Bear Markets by Seeking Alpha. Graph courtesy of Macrotrends.

You may recall an analogy I frequently use to describe the turbulence in stock market prices:

Have you ever been on a commercial airplane flight when it ran into clear-air turbulence? Probably most airline passengers have at some point. I have. What did the pilot, who was in it with us, tell us to do? The pilot likely said, “We’re experiencing some turbulence, so everyone please take your seat and put on your seat belt. We have a worthy aircraft, your pilots and crew are well-trained for this, and we have been through this before.”

Going through the ordeal was probably scary, and certainly not fun or enjoyable. But one thing the pilot didn’t do was walk down the aisle, open the cabin door, and ask, “Who wants out?”

But let the stock market go down with a lot of turbulence and being only human, we painfully experience “losing money” rather than just a temporary set-back in prices. Yet there has never been a time historically when the markets went down that it didn’t go back up … then continue higher in the long upward march of capital markets over time. Rinse and repeat.

Again, I’m not predicting the future, and despite the genuine current problems in our world (it’s always something) I’m still optimistic for the future of capitalism. Taken as a whole, the long-term upward path in corporate earnings, dividends, and values of great companies is solidly positive, in my opinion. Besides, the rational business leaders of the companies we own routinely adjust to business challenges and economic conditions for the long run.

So, the question isn’t “Will there be turbulence in the markets?” or “Can the market go down 50%?” The relevant question is “How will we react to the inevitable market movements?” Jumping out could turn a temporary price set-back into a permanent loss.

I hope you will think of us as your pilot and crew and know that we are well trained for this and have been through market turbulence before. Please call if you would like to discuss this topic further.

This material was written and prepared by Glen Starr, CFP®

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. LPL Tracking #1-05369082